AI-native employee management for ambitious companies

Built for ambitious, fast-growing companies. AI agents handle payroll, compliance, and benefits so your team doesn't have to.

Built for ambitious, fast-growing companies. AI agents handle payroll, compliance, and benefits so your team doesn't have to.

Trusted by finance and HR leaders at fast-growing companies

Most HR and payroll systems force you to choose: complex tools with painful implementations, or simple tools that break as you grow. Finance and HR teams waste hours on manual compliance, chasing tax notices, and stitching together point solutions.

Warp opens every tax account, files every return, and resolves every notice automatically.

In penalties avoided for customers

Saved for finance and HR leaders

Instant tax notice resolutions

Average annual savings per company

Average employee onboarding time

"Warp has been essential for our growth. We can focus on building great products instead of worrying about payroll."

John Kim, CEO, Paraform

Read story

"Using Warp feels like the first time I used Linear or Superhuman. The realization that payroll can just work. Never think about payroll again."

Daksh Gupta, Founder, Greptile

Read story

"We switched from Rippling to Warp and scaled from 10 to 100 employees. The difference has been striking. Warp delivered on rapid growth without breaking down every week. The basics work reliably."

Sobhan Nejad, COO, Bland AI

Read story

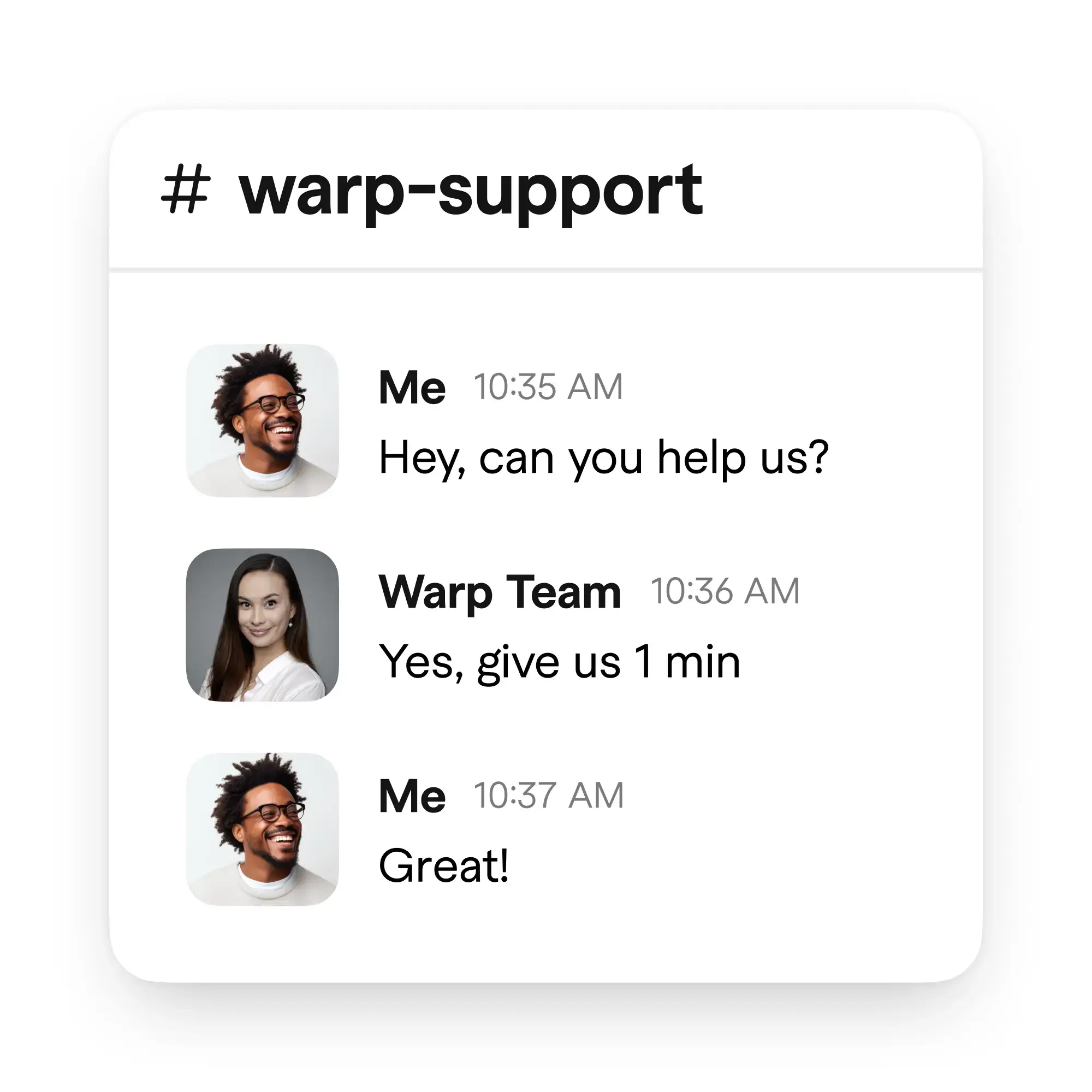

"Warp took 5 minutes of effort to set up. It's totally worth it for the peace of mind. Ayush and his team respond in minutes to any questions I have."

Raunak Chowdhuri, Founder, Reducto

"It's like Stripe for payroll. Really slick tbh, bullish on founders. It's serving my needs right now. I churned my Rippling contract to use them."

Sigil Wen, CEO, Extraordinary

Payroll, benefits, compliance, and integrations in one platform. Built for finance and HR teams at fast-growing companies.

Hire in California today, New York tomorrow. Warp automatically handles tax registrations, agency payments, and quarterly filings. Scale from 10 to 500+ employees across 50 states.

Warp is a licensed insurance broker. We handle carrier negotiations, premium reconciliation, qualifying events, and open enrollment. From health and dental to 401(k) and HSA/FSA, your benefits scale with your team.

Our agents monitor regulation changes across 10,000+ tax jurisdictions, automatically updating calculations and filing requirements. When notices arrive, AI triages, researches, and resolves them before they reach your inbox.

Public API for custom workflows. Native integrations with QuickBooks, Xero, NetSuite, Okta, and your existing stack. Programmatic access to payroll data, reporting, and compliance operations.

Hire in California today, New York tomorrow. Warp automatically handles tax registrations, agency payments, and quarterly filings. Scale from 10 to 500+ employees across 50 states.

Warp is a licensed insurance broker. We handle carrier negotiations, premium reconciliation, qualifying events, and open enrollment. From health and dental to 401(k) and HSA/FSA, your benefits scale with your team.

Our agents monitor regulation changes across 10,000+ tax jurisdictions, automatically updating calculations and filing requirements. When notices arrive, AI triages, researches, and resolves them before they reach your inbox.

Public API for custom workflows. Native integrations with QuickBooks, Xero, NetSuite, Okta, and your existing stack. Programmatic access to payroll data, reporting, and compliance operations.

You hired finance and HR leaders to drive strategy, not chase tax notices. Warp automates compliance, benefits administration, and payroll operations so your team focuses on what matters: scaling the business.

We're not building chatbots. Our AI agents handle complete workflows, from tax registrations to notice resolution to benefits reconciliation. Production-grade automation that replaces entire categories of admin work.

Most companies outgrow their payroll provider by 100 employees. Warp is built to scale from 10 to 500+ employees without forcing you to migrate. One platform, from day one to IPO.

Full-service payroll for employees and contractors in all 50 states.

Warp AI agents register every account, file every return, and keep you compliant.

Offer health insurance and 401(k) plans at startup-friendly rates. Warp syncs deductions automatically with payroll - no manual setup, no missed contributions.

Pay global contractors in over 150 countries in US dollars or in their local currency.

Grow your team without growing your HR and admin overhead. Warp automates the busywork so you stay lean.

We handle every tax obligation, state to federal, so you can focus on building. No spreadsheets or missed deadlines.

Connect your stack, from banking to benefits, into one platform. No more juggling tools.

Real people, no bots. Our U.S.-based team replies in minutes so you can get back to work.

How is Warp different from other platforms?

Who is Warp built for?

How long does it take to migrate to Warp?

Does Warp handle multi-state compliance and benefits?

Can Warp integrate with our existing tools?

What kind of support does Warp offer?

How does Warp's AI actually work?

What does Warp cost?